What are NFTs anyway? And how are they shaking up the art market? We sat down with Patricia Pernes, General Counsel for Bonhams in New York, to discuss the multi-million-dollar NFT market and its impact on the future of art collecting.

April Richon Jacobs (ARJ): Everyone’s talking about NFTs! What are they, if you could explain them in a few words?

Patricia Pernes (PP): An NFT (non-fungible token) is a line of code that is created (minted) through a smart contract (a series of self-executing protocols), which assigns ownership and manages the transferability of the NFT. NFTs exist on a blockchain – a public ledger that allows anyone to verify the NFT’s attributes and transaction history. An NFT may also reference or link to a digital asset, such as a digital work of art. While most digital items can be endlessly reproduced and easily altered, each NFT has a unique digital signature, meaning it is one of a kind, so the token proves that the referenced or linked copy of the digital file is the original. The NFT acts as a passport or a deed, conveying access or other rights (including potentially ownership, depending on the manner or terms pursuant to which the NFT sold) to the referenced digital asset.

ARJ: Why would a collector purchase an NFT versus a traditional “tangible” object like a painting or sculpture? What is the appeal?

PP: NFTs can be used in connection with anything digital: static, dynamic, or generative works of visual art, video clips, music, players in an interactive game – or the game, an AI, digital sneakers or furniture for VR environments; the possibilities abound. Much of the current excitement is around using NFTs in connection with digital art because it’s a framework that provides a more practical way to establish authenticity and designate ownership. NFTs make transacting in digital art more accessible, which is an inflection point for this medium.

NFTs bring a novel and dynamic dimension to art and collecting. Bonhams is currently offering the first NFTs for ballet. World-famous ballerina Natalia Osipova, the principal dancer at The Royal Ballet in London, has performed three pieces, which, through NFTs, are crystallized as unique works that can be owned and collected.

ARJ: Can you paint us a picture of a typical NFT collector? Who are they, where do they live and are they young and tech-savvy?

PP: Certainly tech-conversant and inquisitive. Likely an early(ish) crypto adopter who has benefited from growth in the space and is now exploring art and collecting. While most transactions occur via blockchain based NFT platforms, auction houses are expanding the reach of NFTs to “off-chain” collectors, so the picture of the “typical” collector is morphing.

ARJ: Do NFTs have to be purchased with crypto currency? If so, does Bonhams accept crypto?

PP: Many NFT art platforms require payment in crypto, however some have opened up the NFT marketplace to a broader user base by accepting payment in crypto or fiat (normal, government issues currency), at the buyer’s election. Bonhams takes the latter approach, allowing buyers of NFTs to choose their preferred form of payment – fiat (payable in the currency of the saleroom conduction the auction) or crypto (currently ETH).

ARJ: Can you make any projections about how NFTs will be part of the future of art collecting? Are they here to stay or are they a passing fad?

PP: NFTs are here to stay, especially for digital art and collectibles. They are a milestone for artists and collectors and have been embraced for their practicality and potential. I anticipate further technical refinement and increasingly sophisticated application as a growing number of artists, performers and creators leverage NFTs to reach and connect with a broader audience and to administer their commercial rights.

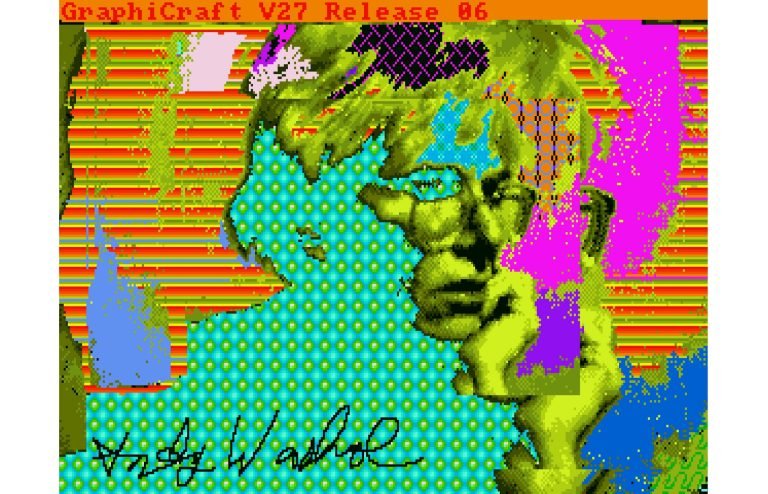

ANDY WARHOL (1928 – 1987)

Untitled (Self-Portrait)

non-fungible token (tif)

4500 x 6000 pixels

Executed circa 1985 and minted in 2021.

Price realized of $562,500.

Imagery courtesy of Christie’s Images Ltd. 2021.